Trump’s New Tax Reform Plan

The latest overhaul of the U.S. tax system has business owners and individuals wondering: “What does this mean for us?” It’s been 30 years since the last major tax overhaul which happened in 1969 under the administration of former president Ronald Reagan.

The Senate passed the “Tax Cuts and Jobs Act” bill on the 20th of December 2017. Two days later, on the 22nd of December 2017, President Donald J. Trump has officially signed the bill. So what exactly is the purpose of this new legislation? While the GOP didn’t make any tax code simplifications, they did aim to make things a little easier for business entities and reduce the load of the taxpayers.

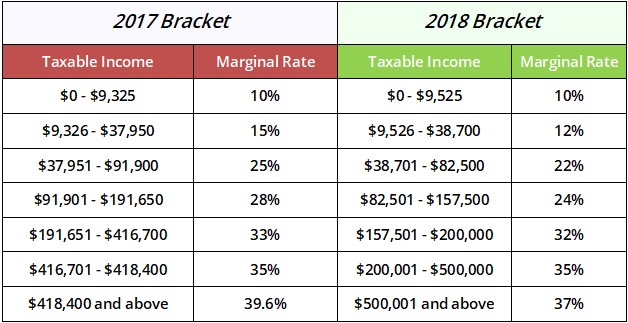

The tax brackets of 2018

For single filers:

For married taxpayers paying jointly:

Many Republicans saw this tax reform as a great win for everyone, including the middle class. But who experiences the biggest benefit? The plan wants to cut tax breaks equally for everyone regardless of their economic status. Looking at the new tax brackets above, it’s easy to see how the highest-earning people get the most savings. Also take note that with the new tax cuts, the country is expected to amass $1.7T federal deficits.

Trump’s Tax Reform 2018 for businesses and individuals

With economic growth in mind, the new GOP tax bill wants to encourage corporations and small businesses to invest and expand. Subject to certain limitations, the income from certain corporations and partnerships will be treated as Qualified Business Income under section 199(A) of the Internal Revenue Code. If applicable, the owners of S Corporations, Partnerships, Sole Proprietors, and beneficiaries of trusts may claim a 20% deduction of net income. This deduction is subject to taxable income thresholds and other phase-out limitations for single and married filers.

With economic growth in mind, the new GOP tax bill wants to encourage corporations and small businesses to invest and expand. Subject to certain limitations, the income from certain corporations and partnerships will be treated as Qualified Business Income under section 199(A) of the Internal Revenue Code. If applicable, the owners of S Corporations, Partnerships, Sole Proprietors, and beneficiaries of trusts may claim a 20% deduction of net income. This deduction is subject to taxable income thresholds and other phase-out limitations for single and married filers.

Owners of C corporations need not worry, though. The corporate tax rate was reduced from a top rate of 35% to a flat 21% tax rate. On the other hand, they are still subject to possible double taxation—one for the earnings of the corporate entity and another for any distributions of income to shareholders from the said earnings.

The largest changes for individual filers come in the cap for the State and Local Tax deduction and the loss of personal exemptions. State and Local taxes include, but are not limited to, property taxes paid on your primary and secondary residence and your state withholding from your paycheck. The new tax reform puts a cap of $10,000 on this deduction. Additionally, subject to certain income thresholds, individuals could take an exemption deduction of $4,050 per person for 2017. Under the new tax reform, the exemption deduction was eliminated. To offset this loss, the standard deduction for single filers has increased from $6,350 in 2017 to $12,000 in 2018 and for married filers from $12,700 in 2017 to $24,000 in 2018.

Summary

It is very important to understand that the new tax reform affects each business and each individual differently. Please feel free to contact me if you have any questions regarding how these changes will affect you personally.